Health sector needs higher budget allocation:simplification of GST and tax relaxation. There are some basic expectations from the upcoming Union Budget for 2021, especially in these pandemic stricken times. In the long-term, we need more investment in R&D, equipment, more hospitals, and in improving the overall infrastructure.

2020 has been an unusual year for the healthcare sector as the national focus shifted to containing the spread of the COVID-19 pandemic. Private hospitals like Saifee were at the forefront of this critical effort in treating patients at very nominal rates as per the BMC notifications. However, our own revenues suffered as other services were affected severely.

Given these circumstances, we would welcome any financial support by the government in the form of concessions in property tax or utility bills. The pandemic also stretched thin our national healthcare infrastructure in the initial period when there was a rush of patients.

According to Mr. Mustafa Daginawala Chief Finance Officer Saifee Hospital, Mumbai health sector needs an urgent higher budget allocation. In the long-term, we need more investment in R&D, equipment, more hospitals, and in improving the overall infrastructure. In the short-term, we need budgetary allocation for vaccines at exempted or no cost.

The silver lining to this crisis was the much-needed focus it brought to the healthcare sector as the government pushed for affordable testing and treatment for everyone. This budget should reflect these concerns for universal quality care and vaccination for everyone.

Ms. Dipali Mathur Dayal, Co-Founder, and CEO of Super Smelly says “The year 2020 was tough and a good, strong budget will come as a relief. We hope it is consumption-friendly, leaving more money in the hands of people to catalyze demand in the economy. Moreover, for start-ups, we look forward to the simplification of GST and tax relaxation in ESOPs.”

She further adds, MSME and startups would need government support to revive businesses and to continue to generate employment therefore easy and cheaper access to the credit would certainly bring relief. The personal care sector, in particular, needs steady budgetary support. There is a nationwide movement to transcend from large-scale toxin-based products from international brands to natural, homegrown, and toxin-free brands. Therefore it is important to emphasize the importance of Make In India and vocal for local to strengthen the country’s economy.

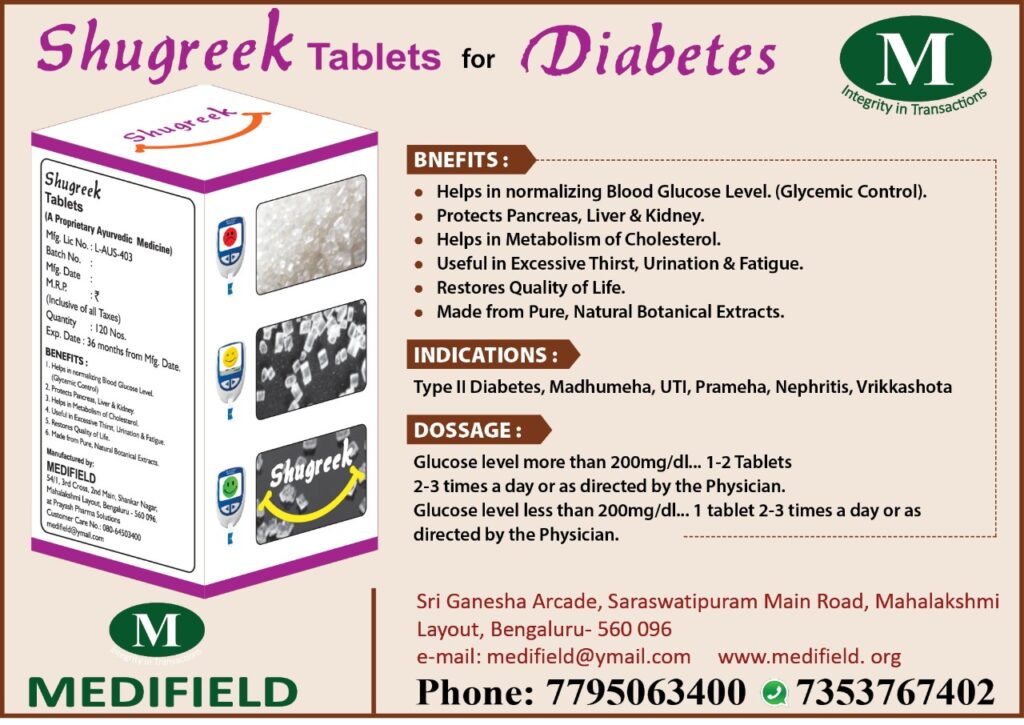

Mr. Vishal Kaushik, Co-Founder and MD at Upakarma Ayurveda, says “The healthcare sector is looking forward to more promising announcements from Budget 2021. During the pandemic, PM Modi has given the much-needed push to the domestic Ayurveda sector as he encouraged the world-class R&D enablement and manufacturing capabilities of India.

We are expecting the GST to be brought down from the current 12% which is levied on products that have the license to sell as Branded Ayurvedic Medicines. This will further help with cost reduction and easy accessibility of the product. The government can also look at providing funds for Ayurvedic practitioners and centers, which will further encourage the domestic and offshore investors to put faith in India for new product developments.”

Mr. Kapil Bhatia, CEO, UniMask says “MSME has always been the backbone of the Indian Economy with around 29 percent share to India’s GDP. We expect the government to re-establish favorable policies and allocate substantial funds for the growth of MSMEs. 2020 was a blessing in disguise for MSME industry where the initial most of 2020 was quite brutal but the later half came to the rescue especially with the #boycottchinesegoods campaign and push towards Make-In-India. The MSME sector is hoping to get rid of challenges like lack of access to capital, infrastructure, skilled labor, and power supply issues that plague MSMEs in India. Therefore, Indian entrepreneurs hope that the Union Budget 2021 will provide some long-term benefits to the sector with better access to credit and lenient taxation policies.”

According to Harshit Jain MD, Founder and CEO, Doceree, The pandemic hit India’s healthcare severely and in spite of waiting until 2015 to reach the target of 2.5% of GDP to be spent on healthcare, the government should eye reaching it in the next two years so that healthcare infrastructure in the country could be improved. It is also high time that the spend is significantly increased, given the population of our country is so huge. Additionally, while universal health coverage is a welcome step and so is the idea of Health IDs, they must not remain on papers and get mired in red tape, facing delays. In the upcoming budget, allocations and timelines should be announced so that they get implemented in an organized manner and we are closer to realizing the vision of making healthcare accessible and affordable. Besides, innovative healthcare startups that are working to promote accessibility and affordability should be encouraged by way tax benefits and tax holidays so that government and private partners can work together to make the condition of Indian healthcare better.