Health insurance is always is the best way to contribute to the well-being of his/her family. If family health insurance is so critical, then how do you decide which is the best fit for you? Here are a few things you might want to look at while making a decision.

Any person is always eager to contribute to the well-being of his/her family. When you are shouldering such a responsibility, the mental and physical health of your family members is the priority.

The ideal way to ensure you and your family members are protected is to buy health insurance as soon as you can. Family health insurance ensures you are giving your loved ones access to the best medical care and securing their present and future.

It is a smart way to get your family under the cover of insurance without compromising on any of the benefits and controlling the premium as well. Family health insurance packages ensure all members of your family, old and new, are well looked after. You can customize the package as per your needs and get the best deal.

If family health insurance is so critical, then how do you decide which is the best fit for you? Here are a few things you might want to look at while making a decision.

Also Read – Health insurance policy : what is the need?

Factors to consider while buying health insurance for family:

1. Assess the members to be included – The primary factor to consider is how many members and who all do you wish to get insured. If you are a smaller family or just a couple of you, then the Family floater health insurance plan is recommended for you.

If you are a big family with dependent aged parents, then the individual family floater plan is recommended for you. The difference is that in the first one you get a combined amount which has to be shared amongst all family members while in the latter, every person is assigned a separate amount.

The kind of policy you should get is largely dictated by the age group of the family members you wish to insure. Older people generally require more medical attention and the plan you choose should reflect this requirement.

2. Calculate the premium of policies – Designing a health insurance plan around your budget can be tricky when you wish to take care of the whole family. The best tool at your disposal is the health insurance premium calculator that can tell you the premium you will end up paying each month.

This will not only allow you to chart a course for your financial journey through the year but also give you a fair idea of whether the policy chosen by you fits in your budget or not. A premium calculator is a handy tool when you are comparing different policies and want to consider the impact of the premium paid on your savings.

Since health insurance is one of the tax-saving options you have, the premium calculator gives you a fair idea of how much you are contributing to the tax-free pot monthly as well.

Also Read –Health insurance policies need to be more women-centric

3. Identify the benefits – Premium, settlement ratio, and other such statistical data would not make any difference if the benefits of the family health insurance policy do not align with your requirements. Here are a few benefits you wish to look at when you are considering buying insurance for your family.

a. Critical illnesses – You should consider investing in your family’s health rather than a specific policy. A policy that covers critical illnesses like kidney failure, heart attack, and so on is important especially when you have aged parents depending on you. With the drastic lifestyle change, it is also possible you may have to use this cover for yourself, irrespective of your age.

b. Accidental hospitalization – Mishaps cannot be predicted and this benefit is essential irrespective of the age group of your family members.

c. Annual health checkup – Prevention is better than cure and early detection of illnesses can save a lot of time and pain. Annual health checkups are important for everyone to be done to avoid difficult situations. Psychiatric benefit

Also Read – Demand for health insurance policies have increased

4. Consider buying the additional benefits – Along with the requirements of your current family, you also need to think about what you might need in the future. If you are planning to build a family soon, then you may wish to look at maternity benefits with newborn baby cover.

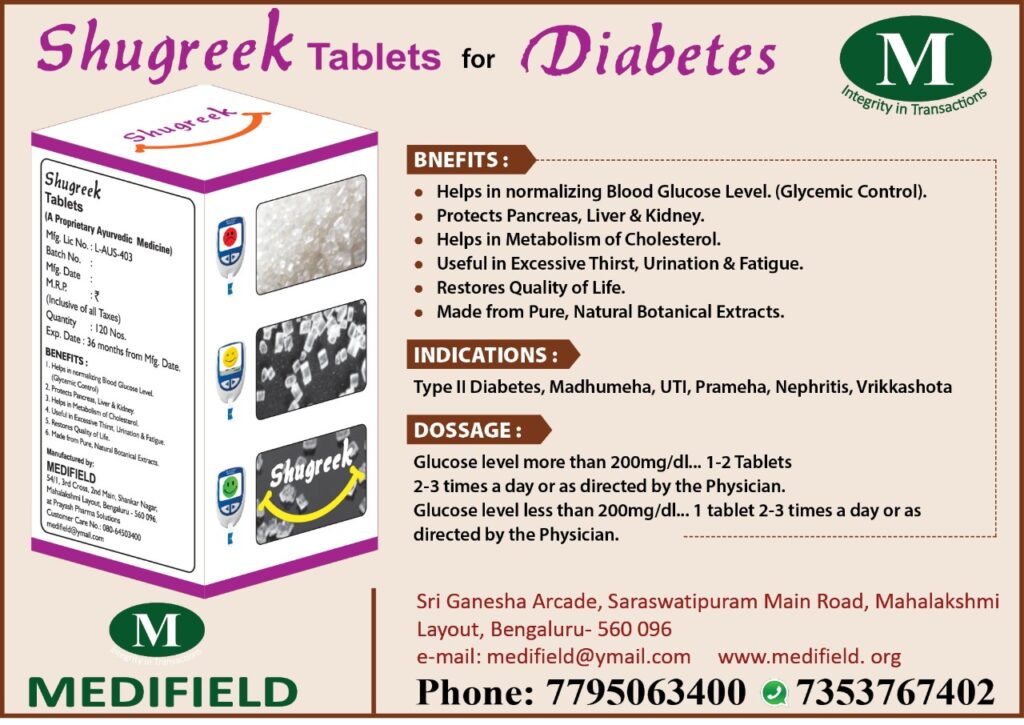

There are a few additional factors that you need to consider. For example, if you prefer alternate treatments like Ayurveda, Unani, Siddha, or Homeopathy, you can have that additional benefit added to your family health insurance.

If you plan to move during the year, you should consider looking at the zone upgrade which allows you to get access to medical attention in a different city (zone) with any hiccups along the way.

5. What is not covered? – Just like you need to be aware of what is covered under your insurance policy, you should also be aware of what is not covered under it. Reading the fine print ensures you are not stuck in a sticky situation when you need the help of your family health insurance policy.

Pre-existing illnesses have a waiting period before the clause of the health insurance policy is applicable. During the waiting period, no claims can be made concerning the critical illnesses declared before.

Pre-natal and post-natal medical expenses are not covered unless it leads to hospitalization. Generally, hospitalization that is not recommended by the doctor is also not covered under the family health insurance policy.

Also Read – What is health insurance policy

The factors to consider while buying family health insurance may seem daunting but they make your life easier in the long run. The impact of these policies may be deeper than anticipated by you.