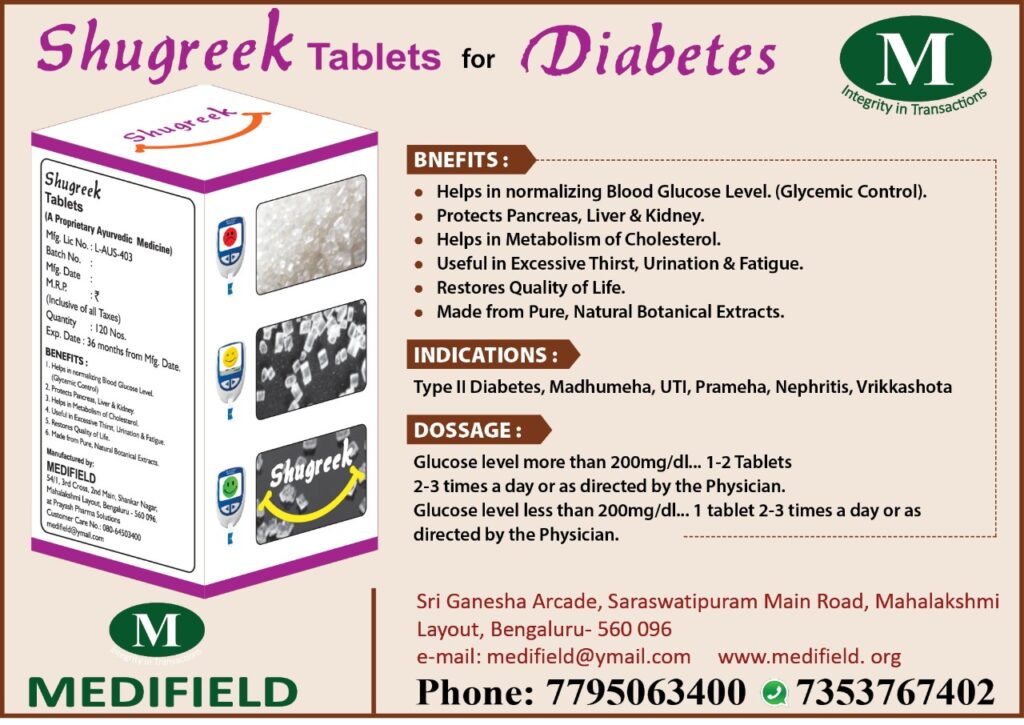

Economical Implications of COVID19 could cost the Indian economy between $387 million and $29.9 billion in personal consumption losses .In response to this global outbreak, we summarise the socio-economic effects of COVID-19 on individual aspects of the world economy.

With the World Health Organization (WHO) declaring the COVID-19 outbreak as a global emergency on 30th January 2020, In a response to ‘flatten the curve’ governments have enforced border shutdowns, travel restrictions and quarantine (5,6) in countries which constitute the world’s largest economies, sparking fears of an impending economic crisis and recession.In an attempt to understand the turmoil effect on the economy, we summarize the effect of COVID-19 on individual aspects of the world economy, focusing on primary sectors which include industries involved in the extraction of raw materials, secondary sectors involved in the production of finished products and tertiary sectors to include all service provision industries.

The trade impact of the corona virus epidemic for India is estimated to be about 348 million dollars and the country figures among the top 15 economies most affected as slowdown of manufacturing in China disrupts world trade, according to a UN report. Whereas according to Asian Development Bank (ADB) the Covid19 outbreak could cost the Indian economy between $387 million and $29.9 billion in personal consumption losses (https://www.livemint.com/). For India, the trade impact is estimated to be the most for the chemicals sector at 129 million dollars, textiles and apparel at 64 million dollars, automotive sector at 34 million dollars, electrical machinery at 12 million dollars, leather products at 13 million dollars, metals and metal products at 27 million dollars and wood products and furniture at 15 million dollars.

China has seen a dramatic reduction in its manufacturing Purchasing Manager’s Index (PMI) to 37.5, its lowest reading since 2004. This drop implies a 2 per cent reduction in output on an annual basis. This has come as a direct consequence of the spread of corona virus (COVID-19). When we see the China’s share in total import to India, India’s total electronic imports account for 45% of China. Around one-third of machinery and almost two-fifths of organic chemicals that India purchases from the world come from China. For automotive parts and fertilisers China’s share in India’s import is more than 25%. Around 65 to 70% of active pharmaceutical ingredients and around 90% of certain mobile phones come from China to India.

Agriculture Sector:

Petroleum & Oil:

During a meeting at the Organisation of the Petroleum Exporting Countries (OPEC) in Vienna on March 6th, a refusal by Russia to slash oil production triggered Saudi Arabia to retaliate with extraordinary discounts to buyers and a threat to pump more crude. Saudi, regarded as the de facto leader of OPEC, heightened its provision of oil by a quarter more than February – taking production volume to an unprecedented level. This caused the steepest one-day price crash seen in nearly 30 years – On March 23rd, Brent Crude dropped by 24% to $34/barrel to stand at $25.70. Although a slowdown in the number of COVID-related deaths has caused some stabilisation of oil prices, there is still much uncertainty.

On the background of a viral outbreak already dampening the demand for oil, this oil-price war is predicted to have grave implications for the global economy. In more ordinary times, cheap oil may have functioned as an advantage for economies. However, savings on petrol are unlikely to be redirected into more spending as populations are instructed to practise social distancing and the working class are uncertain about job security. Furthermore, any increase to consumer activity is likely to be outweighed by damage caused to populations reliant on revenue from other forms of energy such as Shale gas.Economic modelling from Imperial College’s Centre for Climate Finance and Investment has suggested ‘Carbon Dividends’. A £50/tonne of CO2 tax could be channeled into UK households in order to stimulate consumer spending whilst keeping oil prices at the same level as February 2020. However, this relies on turbulence between Saudi Arabia and Russia thus should not be considered sustainable for the long-term.

Manufacturing Industry:

Finance Industry:

COVID-19 has impacted communities, businesses and organisations globally, inadvertently affecting the financial markets and the global economy. Uncoordinated governmental responses and lockdowns have led to a disruption in the supply and demand chain. Initially, in China, lockdown restrictions meant a grave decrease in product supply by Chinese factories, while quarantine and self-isolation policies decreased consumption, demand and utilisation of products and services.As COVID-19 has progressed to affect the rest of the world, China will begin to recover faster than the rest of the countries, strengthening its trade negotiating power against the US. In fact, chinese companies will be in the advantageous position to acquire their western counterparts, which are greatly dependent and will be inevitably affected by the stock market.

In addition to the disruption in the supply chain, the capital market sector has also been affected. In the US, the S&P 500, a stock market index that measures the stock performance of 500 large companies on the US stock exchange, the Dow Jones Industrial Average and the Nasdaq fell dramatically until the US government secured the Coronavirus Aid, Relief, and Economic Security (CARES) Act, with the indexes raising by 7.3% , 7.73% and 7.33% respectively. Furthermore, 10-year US Treasury bond yields have dropped to 0.67%. In the Asian markets, the same pattern followed with China’s Shanghai Composite, Hong Kong’s Hang Seng and South Korea’s KOSPI initially dropping and followed by a rise in stocks after governmental support. Japan’s Nikkei was up 2.01%.Europe’s bond yields mostly declined, reaching market stress hit levels faced in the eurozone crisis of 2011-2012. Germany’s DAX, the UK’s FTSE 100 and the Euro Stoxx 50 were all down on March 23rd, but rose significantly after the EU’s rescue package was agreed. Gold dropped against the dollar by 0.65%.

The decline in global stock markets has festered a volatile environment with critical liquidity levels. To combat these effects, Central banks globally have intervened to ensure liquidity is maintained and mitigate the economic shock, with several leaders embarking on a ‘Whatever it takes’ approach. (7,41) Professor of Financial Economics, David Miles, from Imperial College London has likened such government spending to the post-Napoleonic, first and second world war eras where public sector liabilities rose greatly. He further explains that bond markets could have difficulties in coping with large scale government bond issuance and that central banks may have to intervene by purchasing these bonds on an unprecedented scale.

Healthcare industry:

The COVID-19 pandemic has caused an unprecedented challenge for healthcare systems worldwide. In particular, the risk to healthcare workers is one of the greatest vulnerabilities of healthcare systems worldwide. Considering most healthcare workers are unable to work remotely, strategies including the early deployment of viral testing for asymptomatic and/or frontline healthcare staff is imperative. High healthcare costs, shortages of protective equipment including N95 face masks, and low medical capacity, ICU beds and ventilators have ultimately exposed weaknesses in the delivery of patient care. In the US, there is concern regarding uninsured individuals, who may work in jobs predisposed to an increased risk of viral infection which may lead to significant financial consequences in the event of illness.

Pharmaceutical industry:

Profound changes to the dynamics of healthcare are likely to ensue, leading to massive investment into disease prevention infrastructure, and the accelerated digital transformation of healthcare delivery. In the US, active pharmaceutical ingredients are imported largely from India (18%) and the EU (26%), while China accounts for 13%. China is also the biggest exporter of medical devices to the US, accounting for 39.3%. Production slow-downs and limitations in supply would inadvertently lead to revenue loss.In the UK, Astra Zeneca have indicated that COVID-19 is likely to affect its 2020 revenue growth.

Conversely, opportunities for companies engaged in vaccine and drug development have simultaneously emerged, with US-based companies including Johnson & Johnson, Vir Biotechnology, Novavax and Nano Viricides having announced collaborative plans to develop a viral vaccine. A Phase 1 clinical trial evaluating an investigational COVID-19 vaccine is currently underway, and will enroll 45 healthy adult volunteers ages 18 to 55 years over approximately 6 weeks.

Information Technology, Media, Research & Development :

With the WHO raising COVD-19’s status to a pandemic, 35 companies and academic institutions are racing to develop an effective vaccine. Four potential vaccines are currently being tested on animals with the biotech firm Moderna preparing to enter human trials imminently. The Coalition for Epidemic Preparedness Innovations (CEPI), is leading various efforts to finance and coordinate Covid-19 vaccine development. They have announced a $4.4m partnership funding with Novavax and University of Oxford to develop a viable solution. The Gates Foundation, Wellcome and Mastercard have also committed $125 million to find new treatments for COVID-19.

Social distancing precautions are paramount to the containment effort. Additionally, COVID-19 has left several hospitals in turmoil, having reached maximal capacity. As a result, various countries are turning towards technological solutions, to care for patients and at the same time, minimise the risk of person to person transmission. In various cities across China, tele-response bots powered by fifth-generation wireless networks are being utilised that allow health care staff to communicate with patients, monitor their health and deliver medical supplies. Drones that deliver medication and work-from-home apps are also being adopted. Automation of services has been a major goal for China. COVID-19 has helped to accelerate uptake and has taken them one step closer to this goal.

The demand for respiratory ventilators has skyrocketed due to the outbreak of COVID-19. However, it is clear that the current supply across the United States and Europe does not meet demand. It is estimated that the USA has 160,000 ventilators.This is 580,000 short of what would be required in a severe pandemic to a study conducted by the Centre for Health Security at Johns Hopkins. Governments around the world are attempting to buy ventilators. In the United Kingdom, the prime minister has asked companies such as Rolls Royce and Dyson to divert their manufacturing power to medical supplies. However, industry leaders have stated that this is easier said than done as many of these companies do not produce medical equipment such as ventilators. In addition to this, production of ventilators requires strict regulation and testing to ensure their safety which can be a lengthy process.

Food Sector:

The UK government has also reduced restrictions on delivery hours for retailers in order to allow stores to restock with basic food products. Furthermore, the British Retail Consortium (BRC) has reassured the public that despite low inventory of certain food products in local stores, there are no such shortages of food. Similar statements have been made by the US Food and Drug Administration (FDA). In addition to, and despite reassurance by the government, stores have nonetheless made drastic changes by restricting the amount of each product that people can buy, providing more than 30,000 new jobs to meet the high pressure of restocking shelves, and setting special shopping hours for the elderly, vulnerable populations and NHS stuff. A further change being implemented includes a decrease in the range of products being made by manufacturers, with the aim of focusing on products that are in greater need.

Independent supermarkets have also been affected by the high demand on food products. Measures implemented by these local stores include free delivery of food products to customers to avoid panic-buying, putting restrictions on the number of customers allowed in at any given time to avoid overcrowding, and expanding on the number of suppliers whom they buy their products from to avoid food shortage. Although supermarkets have seen a huge demand on food products, other stores such as restaurants and cafes have been forced to close. As a result, many of these food stores have been put at risk of permanent closure and many of their employees have lost their jobs. This impact of COVID-19 on the food industry has forced Leon, a UK fast-food chain, to change its business model. 65 of its restaurants were said to turn into shops that sell refrigerated ready meal-type plastic pouches.